what is a secondary property tax levy

A tax levy is the amount specific in dollars that a taxing unit city town township etc may raise each year in property tax dollars. A property tax levy is the right to seize an asset as a substitute for non-payment.

Secured Property Taxes Treasurer Tax Collector

The secondary tax is comprised mainly of commitments to satisfy bond indebtedness of jurisdictions fund voter-approved budget overrides and to support the operations of the special taxing districts such as fire flood control street lighting and other limited purpose districts in which your property is located.

. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assetsIt is different from a lien while a lien makes a claim to your assets as security for a tax debt the levy takes your property such as funds from a bank account Social Security benefits wages your car or your home. In other words the issue of whether to be taxed or not for a specific item went before voters in. The second is a quarterly imposition where the tax authority divides each residents total yearly tax levy into four equal payments for the year.

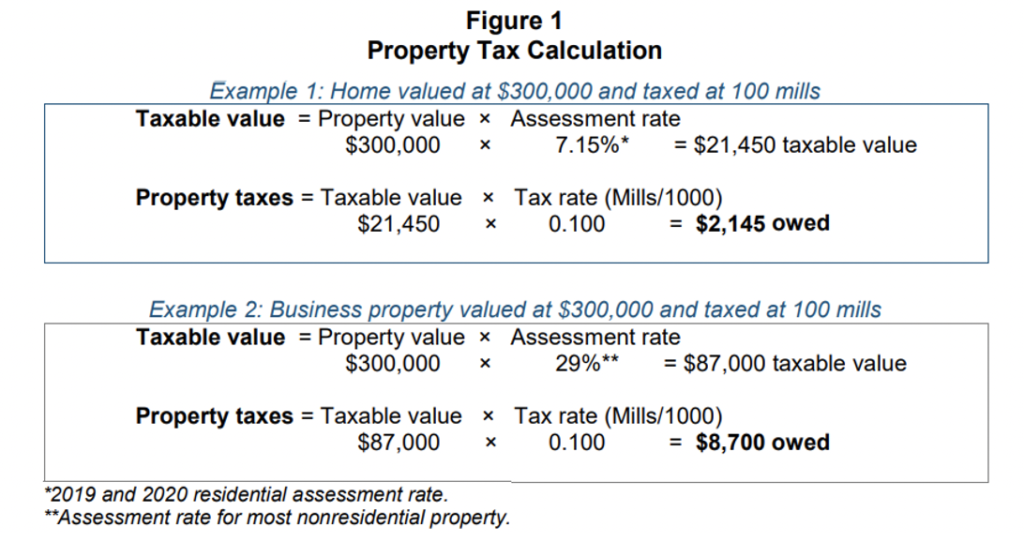

So if your home is worth 200000 and your property tax rate is. The calculation of secondary tax is similar to primary tax but instead is based on the total full cash value To tal FCV of the assessed property as opposed to the limited value. It covers the coming fiscal years debt service from voter-approved bonds for street.

Comprised of the total of the obligation for Special Taxing Districts voter approved bonds and budget overrides that are assessed on valuation. Certain districts levy based on acreage Numbers 5 19 such as Electrical Water and Irrigation versus valuation. As indicated previously the secondary tax levy is the voter approved general obligation debt service for each fiscal year.

The assessed value estimates the reasonable market value for your home. Call 520 724-8650 or 520 724-8750 or Email us for assistance. In addition to the governments ability to impose a tax the word levy also refers to the governments power to seize property to satisfy.

Secondary property tax levy The levy is a 173 million increase from fiscal year 2020-21s 2415 million levy. A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. Starting in Tax Year 2015 Proposition 117 and ARS.

Governments enforce a property tax levy as a measure of last resort. Secondary Property Tax SEC. The IRS can use a levy to satisfy a tax debt.

The City collects a secondary property tax which is used to pay the principal and interest due for debt associated with General Obligation Bonds. Levies are different from liens. A levy is a legal seizure of your property to satisfy a tax debt.

A city or town may levy whatever amount of secondary property taxes is necessary to pay general obligation debt. 42-11001 Subsection 7b now requires using the Limited Property Value Net Assessed Value in determining and levying primary and secondary property taxes on. Where does Internal Revenue Service IRS authority to levy originate.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. 2020 TAX LEVY TABLE OF CONTENTS Note. Paying your levied property tax on time is important.

A property tax levy is known as an ad valorem tax which means its based on the ownership of something. The City uses the tax levy not the tax rate to manage the secondary property tax. Levies are different from liens.

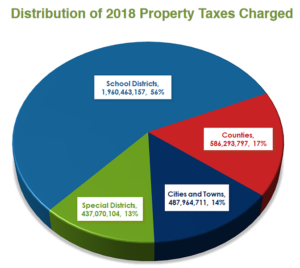

A levy is a legal seizure of your property to satisfy a tax debt. The tax levy is calculated using the formula to the right. 14 Special District Tax.

Residents then pay one-quarter of their full levy. Only property owners are responsible for paying property taxes. November 2 2021 Nora Advices.

A lien is a legal claim against property to secure payment of the tax debt while a levy actually takes the property to satisfy the tax debt. This involves collecting assets and seizure of your property either tangible or intangible in a variety of ways. The Pima County Property Tax Help Line can answer questions about how your property tax was calculated.

A tax levy is a collection procedure used by the IRS and other tax authorities such as the state treasury or bank to settle a tax debt that you owe to them. Secondary Property Tax Rates. Secondary Property Tax Levy debt repayment.

Therefore not paying your property taxes can result in the government seizing your property as payment. In other words the levy is the cap on the amount of property tax dollars a local government is allowed by law to collect. Those who rent or lease their residences will not have to pay property tax unless that payment is mentioned explicitly in the lease agreement.

Under state law cities and towns are allowed to levy a secondary property tax for the sole purpose of retiring the principal and interest on general obligation bonded indebtedness. Property taxes are calculated by taking the mill levy and multiplying it by the assessed value of the owners property. A secondary property tax can only be used to pay back debt on voter-approved items.

Refer to number 4. The secondary tax is calculated using the Limited Value of your.

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Understanding California S Property Taxes

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Honolulu Property Tax Fiscal 2021 2022

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Pennsylvania Property Tax H R Block